Despite its rocky start, 2025 may be shaping up to be a bullish year for Bitcoin. Unlike past rallies driven by pure retail speculation, this time, a unique alignment of macroeconomic forces, institutional adoption, and market structure may drive a powerful and sustained Bitcoin surge.

Despite its rocky start, 2025 may be shaping up to be a bullish year for Bitcoin. Unlike past rallies driven by pure retail speculation, this time, a unique alignment of macroeconomic forces, institutional adoption, and market structure may drive a powerful and sustained Bitcoin surge. This raises the question of whether the crypto market will be bullish in 2025. Here’s why Bitcoin bulls have reasons to be optimistic about crypto being bullish in 2025.

1. The Fed

One of the biggest macro catalysts for Bitcoin in 2025 could be a pivot by the Federal Reserve. After years of aggressive rate hikes to combat inflation, core inflation is now trending downward. The Fed is signaling a pause—and possibly even rate cuts by mid-to-late 2025.

Lower rates mean more liquidity and risk appetite, especially for non-yielding, growth-oriented assets like Bitcoin. Historically, Bitcoin has rallied during periods of easy monetary policy—and suffered when rates rose. If the Fed starts to cut, Bitcoin could regain its position as the ultimate risk-on, liquidity-driven asset.

2. Dollar Weakness

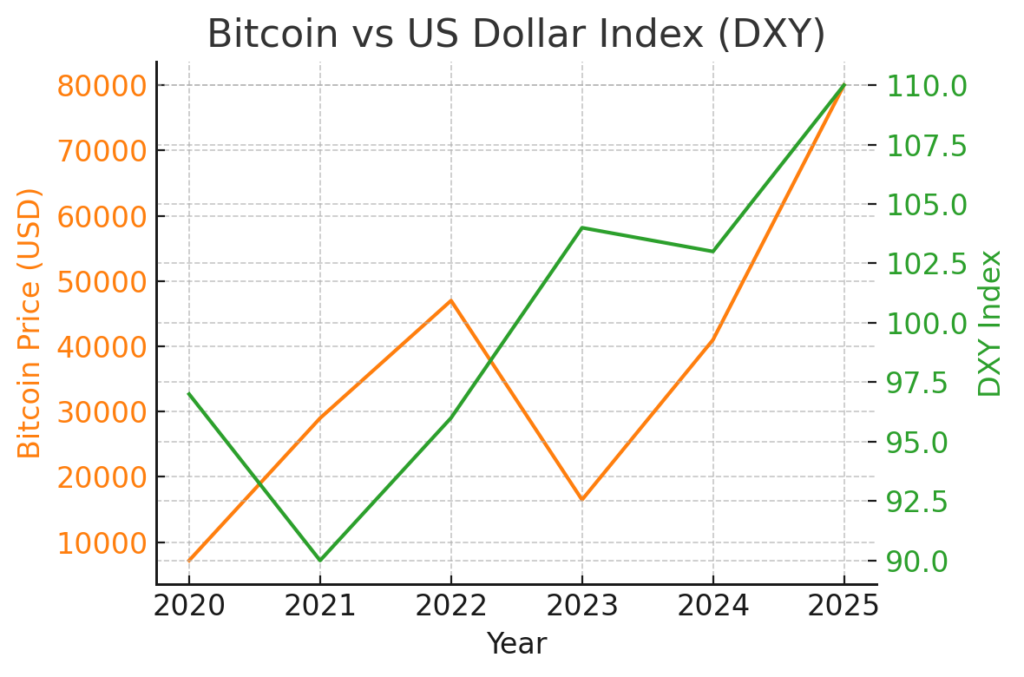

The U.S. Dollar Index (DXY) has historically shown a strong inverse relationship with Bitcoin. In times of dollar strength, Bitcoin struggles. But when the dollar weakens—often due to lower interest rates or geopolitical shifts—Bitcoin tends to thrive.

With rate cuts likely and the U.S. debt situation raising long-term questions about fiscal discipline, 2025 could see the dollar lose ground against other global currencies. For investors seeking a hedge against fiat devaluation, Bitcoin remains the most compelling digital alternative and adds to reasons for expecting crypto bullish 2025 market conditions.

3. ETFs

The approval of spot Bitcoin ETFs in late 2024 was a historic turning point. It opened the door for retirement funds, hedge funds, and family offices to allocate to Bitcoin without the friction of wallets, keys, and exchanges.

Already in early 2025, we’re seeing billions of dollars flow into these ETFs, with BlackRock, Fidelity, and other giants absorbing large amounts of Bitcoin supply. As demand grows and supply remains capped at 21 million coins (with a halving just completed in April 2024), the supply-demand imbalance could create a powerful price tailwind.

4. Real Yields Are Falling

Bitcoin competes with traditional safe-haven assets like gold and bonds. One key metric to watch is the real yield—the inflation-adjusted return on government bonds. When real yields are high, Bitcoin underperforms. But when they fall, Bitcoin shines.

With inflation stabilizing and nominal yields expected to drop, real yields are likely to decline throughout 2025. This reduces the appeal of holding cash or bonds—and increases the attractiveness of Bitcoin as a non-inflationary, scarce digital asset. This anticipated shift enhances the outlook for a crypto bullish 2025.

5. The Nasdaq Effect

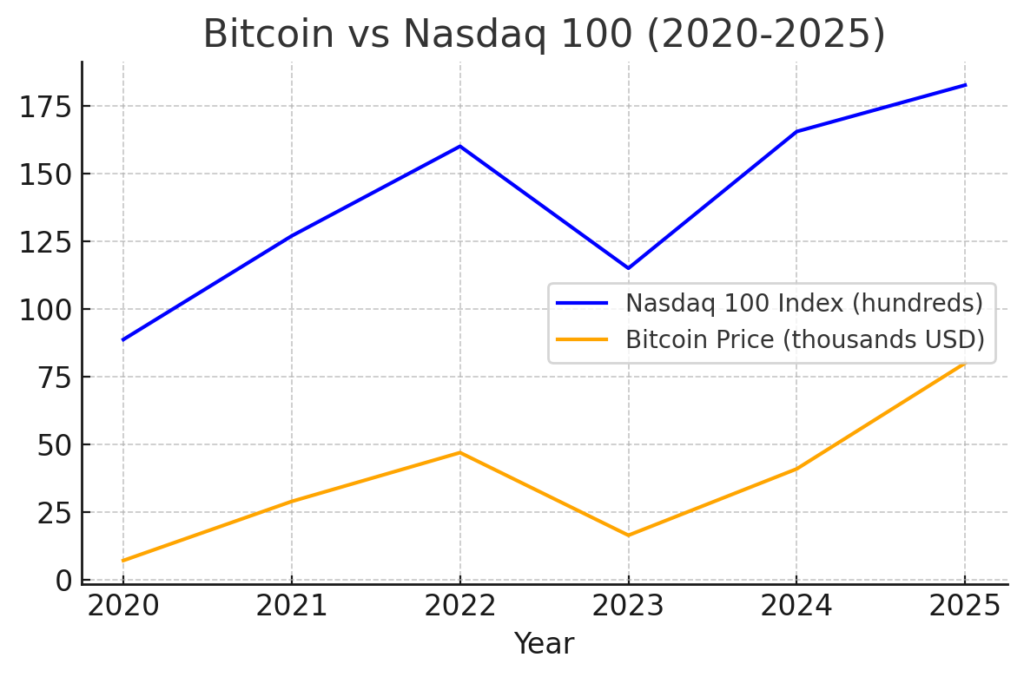

Bitcoin has shown strong correlation with the Nasdaq 100, acting as a high-beta version of the tech sector. As AI, semiconductors, and platform stocks continue to drive equity markets higher, Bitcoin often rides the same wave—amplified.

6. Supply Shock Post-Halving

With markets betting on a soft landing or even a new growth cycle in tech, Bitcoin stands to benefit not just from macro flows but from its identity as a future-forward asset.

The Bitcoin network underwent a halving in April 2024, cutting miner rewards from 6.25 BTC to 3.125 BTC. Historically, the 12–18 months following a halving see outsized price gains as supply issuance slows.

With increasing institutional demand via ETFs and decreasing new supply, the conditions are set for a classic post-halving rally—but on a much larger scale.

A Bull Run with Real Foundations

What makes 2025 different is the maturity of Bitcoin as an asset. This isn’t just about retail speculation or meme momentum. This is about sovereign-level adoption, institutional infrastructure, and macroeconomic alignment. All signs point to a compelling crypto bullish 2025 scenario.

With a weakening dollar, falling real yields, dovish Fed posture, post-halving supply constraints, and ETF-fueled demand, Bitcoin is uniquely positioned to rally. If you’ve been waiting for a moment when Bitcoin has both narrative and numbers on its side—2025 might be it.

Bitcoin bulls, your time may have arrived. Our price forecast is $100,000 to $150,000 by the end of 2025, affirming a crypto bullish 2025.